- DePIN Snacks

- Posts

- EV3's Credit Letter, Part 1

EV3's Credit Letter, Part 1

Investing behind the maturation of onchain credit markets

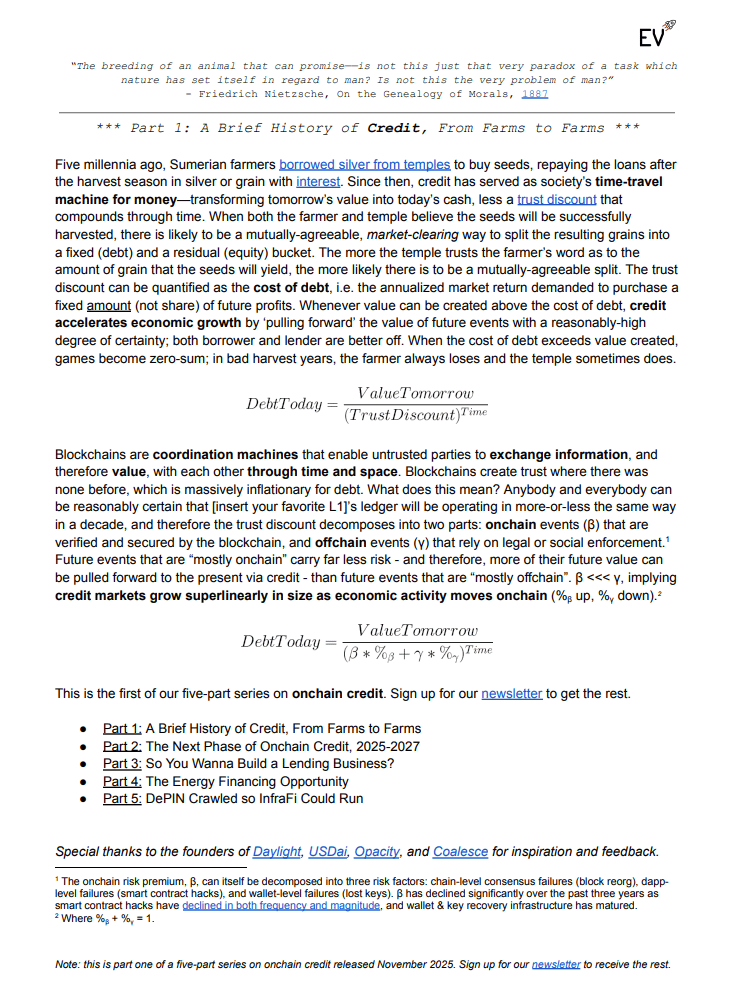

Today, we are publishing part 1 of a 5-part research series on Onchain Credit.

This year, we have met dozens of startups focused on making real-world yields available onchain. Infrastructure financing, from solar panels and batteries, to GPUs and datacenters, to radios and cell towers, are rapidly becoming tokenized. Beyond infrastructure, private credit, unsecured consumer lending, receivables and royalties, and many other types of credit products are coming onchain. As they do, onchain and traditional (offchain) credit markets will converge as yield-seeking capital from both sources seeks to gradient-descent towards the highest risk-adjusted yields.

Our letter analyzes the development of onchain credit markets and the opportunities we believe have the potential to give rise to some of the biggest lending businesses of the decade.

Read the full letter on our website: https://ev3.xyz/research/EV3-Credit-Letter-Part-1.pdf